Today's discussion is on payment for order flow. Ever wonder why stock trading on Robinhood and other brokerage platforms is free? They're selling our orders to third parties like Citadel and Virtu. It's free because we're the product. The SEC is proposing new rules that would effectively end the business model as we know it, but the changes introduce their own challenges that may be even worse for investors.

Hey friends -

🎧 Fat Tailed Thoughts Episode #31 is live! 🎧

We're talking payment for order flow. Ever wonder why stock trading on Robinhood and other brokerage platforms is free? They're selling our orders to third parties like Citadel and Virtu. It's free because we’re the product.

The SEC is proposing new rules that would effectively end the business model as we know it, but the changes introduce their own challenges that may be even worse for investors.

Available on Apple, Spotify, YouTube, and everywhere podcasts are found.

Payment for order flow is not a new topic. It's been around since at least 1984. But it's receiving renewed attention because of the extremes to which Robinhood and others have taken the practice.

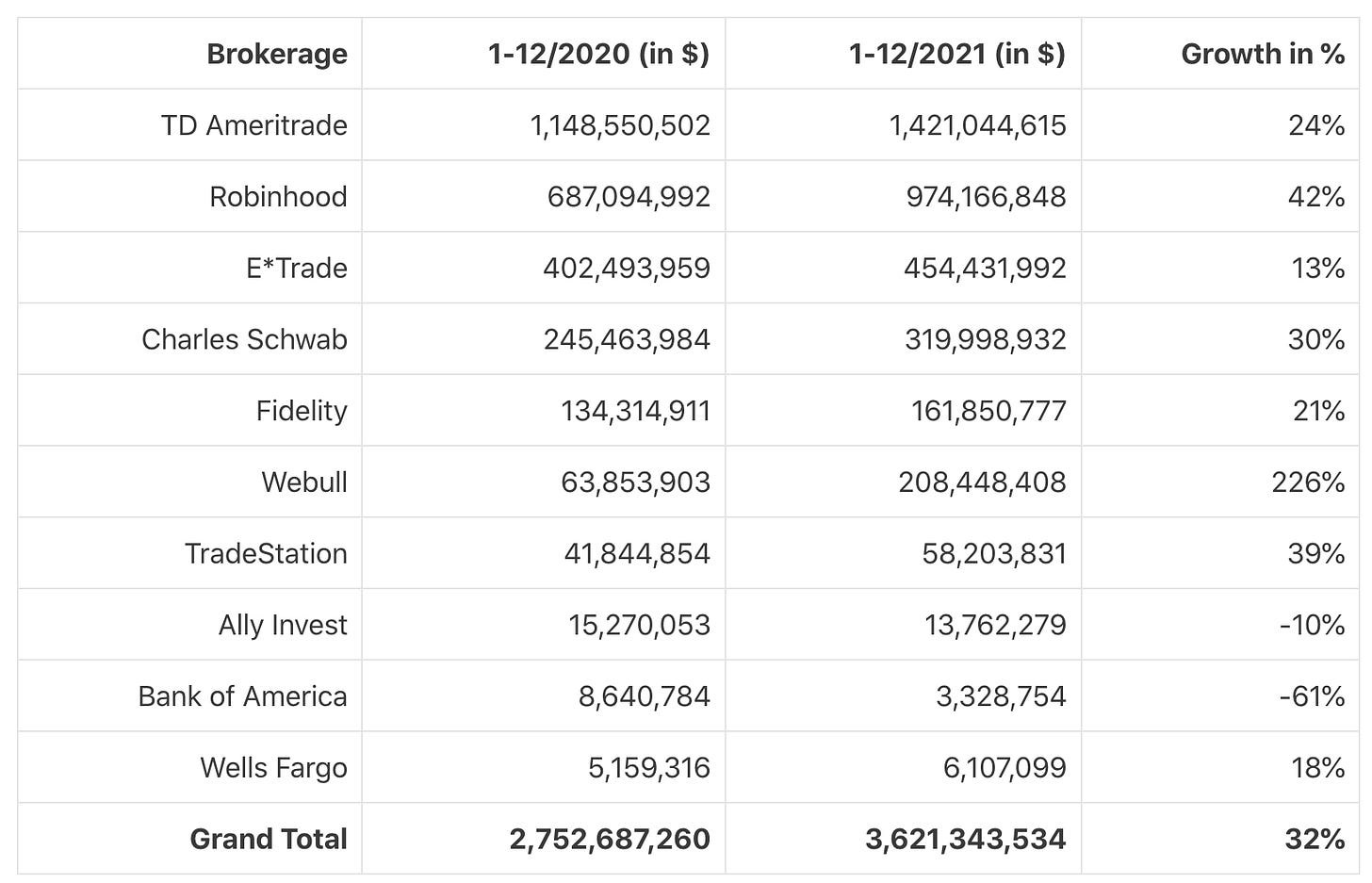

What used to be a cottage industry has ballooned into billion-plus dollar revenues for individual firms growing at over 30% a year. That'll catch the eyes of a regulator even in the best of times. Given the opportunity for investor abuse, it should come as no surprise that the SEC is digging in.

Payment for order flow is one of those unusually well-named practices in financial services - it actually describes how it works. Retail investor brokerage platforms like Fidelity, Robinhood, and TD Ameritrade sell the investors' orders to third parties. Those third parties ultimately trade at the exchanges.

The challenge for retail brokerages is that they're in the business of servicing retail investors - a web application, a mobile application, customer support, and more. They're generally not in the business of trade execution.

In the US, we have many competing venues where stocks can be bought and sold. At any point in time. the price for shares of AAPL may trade at a slight discount or premium at one or more of the venues. But each venue comes with its own nuances. Some venues may process trades faster and others may provide greater guarantees that trades actually go through.

It's a balancing act - price, speed, and settlement. Optimizing for the best trade execution is a hard problem.

We have regulations that require brokerages support best execution for retail investors' trades. They solve that problem by outsourcing - they sell the trades to specialists who provide best execution.

The third parties who purchase investor trades - Citadel, Susquehanna, and others - act as wholesalers. They aggregate small trades into large blocks and then engage as big players on "wholesale" exchange markets.

You could send small, retail-sized trades to the exchanges, but they're likely to get taken advantage of by more sophisticated counterparties. Wholesalers run interference and get paid for the service.

The challenge is that it puts the wholesales in a position of power - they could be the ones abusing investors. Especially when investors think they're getting "zero-commission trading," the situation is ripe for abuse.

The SEC seems to think that's something's fishy. Chairman Gary Gensler directed staff to investigate the matter last year and propose alternate methods for best execution. He provided the initial details of the yet-to-be proposed rules this past Wednesday. They include:

Order-by-order competition - forcing all trades to be routed to transparent auctions rather than sent to wholesalers, and

Minimum price increments - allowing retail trades to be priced in 1/10th of a penny increments, like how wholesalers already trade off exchange.

While these might seem like good ideas that solve the conflict-of-interest challenges of wholesalers, they introduce an entirely new set of problems that may result in even worse trade execution for investors. It's a nuanced topic that begs further conversation.

Join us on this week's podcast to explore.

Available on Apple, Spotify, YouTube, and everywhere podcasts are found.

Cheers,

Jared